Dubai’s blockchain blues & the Kyrgyz ‘cryptatorship’

Last week I went to Dubai. I didn’t much like it; Dubai feels as if the brief was to build a city but to leave out all the things that make cities good. Then again, I was there for a crypto conference. And my overall impression of that was – if Western sanctions are indeed shutting Russians out of the world economy, someone should tell the Russians.

The free ice cream at the gate was sponsored by a crypto company promising seamless exchanges between roubles and the dollar stablecoin USDT; an exhibitor offered to deliver you cash in an hour when you transferred them some crypto; and the title sponsor was A7A5, fresh from being sanctioned by the European Union, but very much alive, kicking, and cheerfully distributing stickers to people who took a spin on its wheel of fortune.

The centre of the hall was dominated by a crypto-trading competition, in which a number of people sat behind screens and sought to make a profit while against the clock. Despite the best efforts of two fast-talking Russian MCs, as a spectator sport, it had all the charm of watching an HR department finishing up the month’s payroll. Still, the competition drew the biggest crowd simply for the lack of other things going on.

None of the whales that might once have come to a Dubai crypto conference were present, now all the action has spectacularly moved to Washington, DC. Check out this Reuters investigation into how much cash The Trump Organization has made in just the first six months of 2025: “the U.S. president’s family raked in more than $800 million from sales of crypto assets in the first half of 2025 alone”, with “potentially billions more in unrealized ‘on paper’ gains”, mostly from foreign sources.

Those who did make it to Dubai intoned the usual verities about crypto ushering in a new age of liberty, despite the huge contradictions all around them. Particularly bewildering was a panel featuring Vít Jedlička, a Czech libertarian and founder of “start-up nation” Liberland, alongside Nabil Arnous, whose job is to bring investment into “Innovation City”, a newly-renamed AI-powered free trade zone in the absolute monarchy that is Ras Al Khaimah, one of the seven emirates that make up the UAE. The blockchain is powerful indeed if it can unite people from such supposedly opposite political poles.

Subscribe to our Coda Currents newsletter

Weekly insights from our global newsroom. Our flagship newsletter connects the dots between viral disinformation, systemic inequity, and the abuse of technology and power. We help you see how local crises are shaped by global forces.

Even more head-scratching to me though was a presentation by Reeve Collins, who co-founded Tether and was an early advocate of all things crypto, He came to Dubai to pitch his idea for “white label” stablecoins which would allow companies to put their name on a dollar-pegged cryptocurrency while leaving all the hard work of running the blockchain to someone else.

Why might companies want to do that? Because every time they sell something, they get to collect even more data about their clients than they already do, as well as earning profit from issuing money that currently goes to the government.

“Since this is programmable money, you get real data on all of the users, and you get to understand who are the power-users, who deserves more, who deserves to be rewarded,” Collins said. “This is loyalty points times a thousand. It really will supercharge what companies are able to offer their users, so they’ll be able to extract more value.”

I kept expecting someone to speak up and point out how far his vision had strayed from cryptocurrencies as a tool for individual autonomy, rather than a tool that enables the world’s largest corporations to frack humanity even harder than they are now. But no one did. Instead, the conference moved onto a panel about how governments couldn’t be trusted.

At some point the music will stop, and none of us will have chairs, and there will be an almighty blow-up. The prospect slightly terrifies me.

Kyrgyzstan’s crypto compulsion

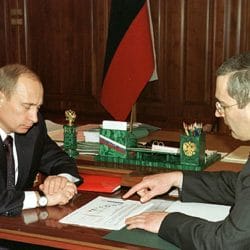

For now, though, the music is very much still playing. Particularly in places like Kyrgyzstan, which seems to be doubling down on its strategy of becoming a ‘cryptatorship’ like El Salvador. Binance founder Changpeng Zhao, the crypto billionaire who pleaded guilty to violating U.S. anti-money laundering laws and was recently pardoned by Trump – though the U.S. president claimed not to know Zhao – headed to Bishkek to talk up its transformation. “Had a great time in Kyrgyzstan in the past two days. I encourage more crypto companies to explore the country too,” he Xed.

There are already a number of crypto companies in Bishkek, including the sanctioned A7A5, and their close connections with the Kyrgyz government are of great interest to the country’s journalists. However, since Kyrgyzstan’s best investigative outlets – Kloop, Temirov Live and Ayt Ayt Dese — have just been labelled as extremists, it will be difficult for reporters to bring attention to their findings.

“This is the first time in the history of Kyrgyzstan when media outlets have been labelled extremist,” said Kloop in a statement. “Now it is dangerous to like or share outlets’ material, or to circulate it. That could all be considered support for extremist organisations and the circulation of extremist material.” At least, “watching and reading it is currently safe.”

There used to be something admirable about Kyrgyzstan’s bloody-minded refusal to become a dictatorship like the other republics of Central Asia. Now there is something grotesque about the fact that it is the lure of crypto, a technology supposedly intended to enhance freedoms, that is helping to cement autocracy. The country is holding snap parliamentary elections on November 30. The president’s party, unsurprisingly, is expected to do very well.

Watching Kyrgyzstan heading towards autocracy is a reminder that the only plausible long-term solution to kleptocracy is for rich countries to stop enabling it. If Westerners started living up to their professed values, and made it impossible for crooks to buy property and launder money in the West, it would reduce the appeal of being one.

A version of this story was published in this week’s Oligarchy newsletter. Sign up here.